President Donald Trump is rolling out tariffs, which at the time of this writing continues to evolve, and there are a lot of mixed feelings about it. Rather than focusing on politics, for today’s blog I want to focus on the opportunities and the technologies. It is time to pave a path forward. Let’s use the tools at our disposal to gain a competitive advantage in today’s supply chain.

First a primer: In a release from the White House at the beginning of February, we see President Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. Energy resources from Canada will have a lower 10% tariff.

While trade accounts for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP, it accounts for only 24% of U.S. GDP. However, in 2023 the U.S. trade deficit in goods was the world’s largest at more than $1 trillion, according to the White House release.

One of the factors driving tariffs is the goal of bringing American manufacturing back to the United States—something I wrote about in my book Mending Manufacturing: How America Can Manufacture Its Survival more than two decades ago. My objective was to urge Washington to act swiftly and decisively and to encourage manufacturers to rebuild their manufacturing enterprises.

Today, the questions remain. What impact will tariffs have on business—and is there a way business can actually use this as a competitive advantage?

This is precisely the conversation I had with Calum Mair, commercial director, North America, EPD, last week on The Peggy Smedley Show. He says tariffs from Canada and Mexico have the potential to really shake up the construction industry, with both pros and cons and even hidden opportunities for the construction industry.

Doug Carlson, CEO, NUCA (National Utility Contractors Assn.), also chimed in sharing his thoughts about the potential roadblocks for construction, saying, “The Trump Administration should provide automatic relief from these additional duties for those steel and aluminum products required for infrastructure construction, which are manufactured elsewhere until such a time that our domestic manufacturing base gets the support and regulatory relief they need to meet demand without dramatically increasing costs to the taxpayer.”

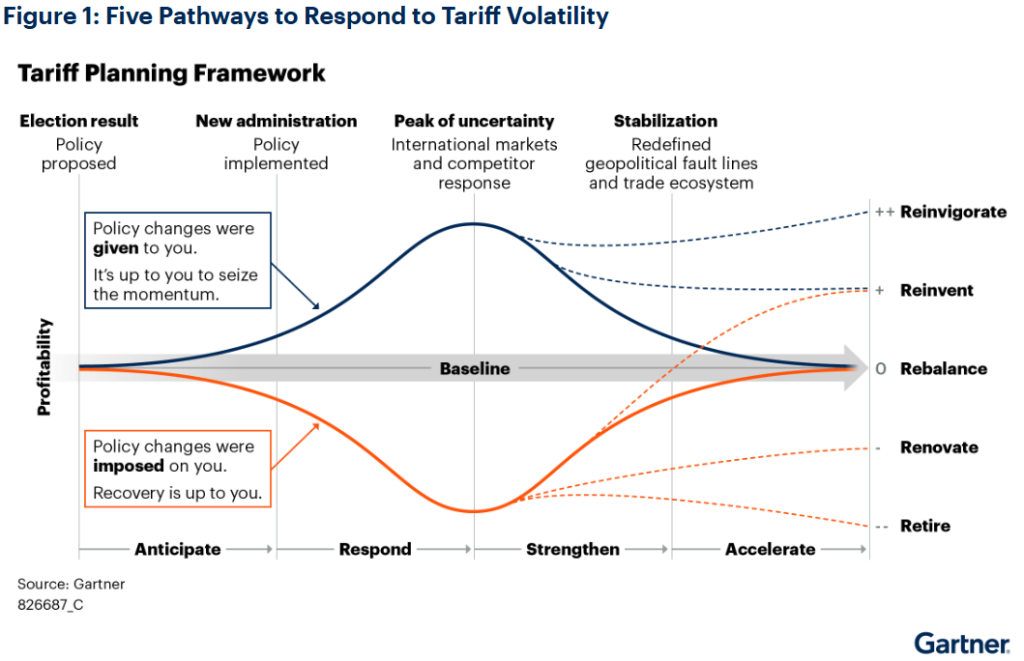

A new release from Gartner also suggests there are hidden opportunities for supply chain organizations, with five possible pathways to consider.

Retire: Some companies may consider discontinuing a product, if absorbing the cost or passing the cost on to the customer is not a viable option.

Renovate: Other companies may choose to recreate a product and make adjustments to products that have been needed for a while.

Rebalance: Companies must also be ready for potential countermeasures, policy escalations and de-escalations, and competitor responses. We are only in the beginning days here.

Reinvent: Some companies may look for new opportunities in new markets, pivoting as needed, and investing in markets not impacted by geopolitical considerations.

Reinvigorate: Other companies may look to expand domestic manufacturing capacity, positioning their company for success in this new market.

Either way, at the end of the day, businesses must be prepared for what tariffs could mean for business. Will companies absorb new costs? Will they pass it along to the consumer? Or, perhaps, there is a third option. Maybe we can recognize new ways to create new efficiencies in business, opening up new opportunities for all. That is just something to ponder in your business.

Want to tweet about this article? Use hashtags #IoT #sustainability #AI #5G #cloud #edge #futureofwork #digitaltransformation #green #ecosystem #environmental #circularworld #tariffs #supplychain