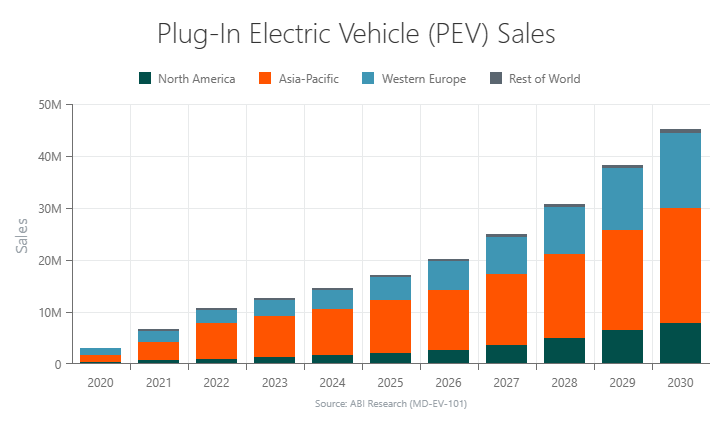

Imagine the frustration of inventing the light bulb five years before there was electricity readily available to power it. In many ways, that is the status of the growing EV (electric vehicle) market, ready to take over transportation but still lacking the infrastructure to support it across the nation and the world. It is estimated more than 180,000 public fast charging stations will be required to support 26 million EVs in the U.S. by 2030.

According to the experts at EnergIIZE, infrastructure will remain the biggest barrier to electric vehicle adoption. Infrastructure challenges, such as deployment lead time, costly upgrades, space constraints, and demand charges are impacting a company’s ability to effectively own and operate an electric truck fleet. In response, the group published a guide showing the basics of how to anticipate scaling needs, build out a depot, and engage with the electric utility so that the resulting charging infrastructure matches a fleet’s needs.

- Anticipate scaling needs:

Though a fleet may initially demonstrate just a few electric trucks to determine fleet and operational suitability, it is critical to anticipate potential scaling needs. Your fleet could grow from 10 to 100 electric trucks sooner than you think.

- Infrastructure costs can vary:

Depending on fleet size, truck technology, charging equipment, access to the grid, and power demand, infrastructure costs can vary with factors such as required utility upgrades, trenching and laying down conduit, and additional energy storage.

- Work with your utility:

Working with your utility from the onset of the planning process is critical to understand potential build out requirements, cost, and development timelines.

- Evaluate electric vehicle rates and potential demand charges:

Working with your utility to evaluate electric vehicle rates and potential demand charges is important to avoiding high charging costs while operating an electric truck fleet.

The commercial vehicle charging market is served by a variety of players such as electric commercial vehicle OEMs (original-equipment manufacturers), CPOs (charge point operators), charging equipment manufacturers, and software providers. Several CPOs have initiated projects and pilot charging stations. In North America, ChargePoint, Forum Mobility, Greenlane, and TeraWatt Infrastructure are making efforts to develop charging networks for heavy-duty electric commercial vehicles.

Berg Insight just released new findings about the market for heavy electric commercial vehicle charging infrastructure in Europe and North America. The total number of connected charging points in Europe is forecasted to grow from 6,400 in 2022 to 390,000 by the end of 2030. In North America, the total number of connected charging points will increase from 4,150 in 2022 to reach 378,000 by 2030. These numbers include both public and non-public charging points.

There are several software specific providers offering connectivity solutions for charging, including fleet management tools, peak shaving, and smart charging management. Connectivity will be crucial for managing the charging process effectively and a vital part of the charging infrastructure for both non-public and public charging, according to Berg Insight’s research. This capability enables businesses and charging station operators to have realtime insights into the charging status, availability, and performance of charging points. Connected charging points can be closely monitored and controlled, utilizing surplus energy, or charging during periods of low energy prices.

Software-enabled connectivity also allows for the implementation of advanced load management techniques, optimizing charging processes through algorithms and data analysis. This can ensure a controlled power draw, preventing grid overloading, and enhancing operational efficiency by reducing charging time for individual vehicles. Moreover, connectivity enables drivers to locate chargers, monitor charging availability, book chargers, and manage payments through smartphone apps. The integration of smart-grid technologies and demand response strategies presents additional benefits. Demand response strategies enable charging to be dynamically adjusted based on grid conditions, which reduces peak demand and further enhances grid stability and energy efficiency.

Where Will the Power Come From?

A common question about EVs, one with enormous real-world implications, is: “Can the power grid handle the growing uptake in electric vehicle adoption?” On one hand, increased adoption of EVs is integral to meeting the country’s zero-emissions targets, but it further strains the grid and risks a blackout due to surging EV battery charging needs. As ABI Research shows, the growing demand for EVs presents huge challenges to grid operators and yet market opportunity for companies that can provide effective smart-charging solutions that make the power grid ready for more EVs.

The most significant way electric vehicles affect the power grid, of course, is the added total energy consumption. At the lowest level, if a family decides to replace their two ICE (Internal Combust Engine) vehicles with EVs, this will increase their daily household energy usage by 74%. Imagine every family in America switching to electric cars. Add the growing commercial vehicle numbers and their added charging requirements and the effects would significantly impact the power grid.

Even so, the real challenge is in energy distribution. Many countries have more than enough electrical energy to meet the total future demand for EVs, but that energy isn’t always ready to be drawn when required. In a world where grid imbalances are normal due to increased electricity usage, the last thing a grid operator needs are millions more EV owners, private and commercial, charging their vehicles—and pulling from the grid—at the same time.

To accommodate the increased energy demand from EVs, it makes sense to just simply expand the power-generating infrastructure and re-energize the existing electrical infrastructure. However, such projects would require up to 15 years and numerous resources to complete. This timeline, crucially, does not satisfy most governments’ deadlines to ban fossil-fueled vehicle sales.

Another grid challenge with EVs is the fact electrical systems must be continuously balanced. This ensures the power frequency stays within the safe grid network frequency operating limits. If the grid’s power frequency plunges, the laws of physics kick into action and put a halt to the energy flow immediately. From there, the power shuts down to avoid irreversible damage to the generators.

Given these challenges that come with electric vehicles, governments, grid operators, utilities, EV charging station operators, and other energy supply and distribution stakeholders must adopt smart charging tools and strategies. Only then can they be sure the power grid can handle greater adoption of EVs.

Putting a Dollar Value to it

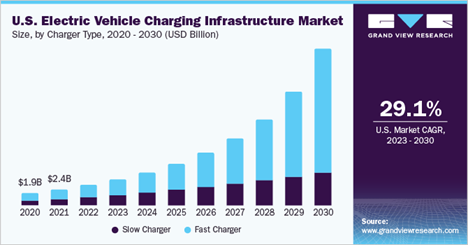

Grand View Research did a study on the value of the global electric vehicle charging infrastructure market. It estimated it was valued at $19.67 billion in 2022 and is expected to grow at a CAGR (compound annual growth rate) of 25.5% from 2023 to 2030. The technological progress of both electric vehicles charging software and hardware is expected to change the way electric vehicle owners use and benefit from electric vehicle charging applications.

The number of commercial charging stations is predicted to increase in line with the growing adoption of electric vehicles. Efforts toward strengthening the charging infrastructure in commercial spaces would be decisive toward encouraging the adoption of electric vehicles, as overnight charging at residential complexes or individual home would not be sufficient for long-distance journeys. Moreover, public charging infrastructure would also facilitate the ultra-fast charging capabilities necessary for long-distance journeys.

EV charging infrastructure manufacturers are collaborating with the car rental industry to integrate chargers in the existing infrastructure. Various automotive manufacturers, such as Volkswagen Group, BMW Group, General Motors, and others, are investing in the development of Car2X technology for charging infrastructure that is further driving the market growth. California is emerging with strong electric vehicle deployment targets, which are expected to have a positive impact and boost the growth of the market.

What Are Chargers?

Currently, EV charging is dominated by comparatively low-tech chargers, with the high-compute applications occurring largely inside EVs, according to Harbor Research. There are three levels of EV charging solutions:

Level 1: This basic charger uses adapters included with most EVs to directly plug vehicles into wall sockets or outlets. It is slow—a maximum of about 5 miles RPH (range-per-hour), and unless a separate meter is installed these chargers typically have no HMI (human-machine interface) and lack even the most basic features like energy consumption monitoring or automatic shutoff.

Level 2: This level enables faster charging using 240V outlets. It requires dedicated hardware, usually SAE J1772 EV plugs and adapters, and charges between 12-25 miles RPH. Possible features of Level 2 include load balancing, remote payment and pricing, app-based wayfinding, and remote maintenance and updates.

Level 3: Also called DCFC chargers, Level 3 chargers are expensive to install, requiring a separate station usually in public venues, but they fuel a vehicle much faster than Level 2 (100+ miles RPH). Today, most Level 3 charging stations are unconnected wall-box solutions or standard 50kW products.

Grand View sees the fast charger segment leading the market, accounting for more than 72% share of the global revenue in 2022. The segment is also anticipated to grow at highest CAGR because of the increasing initiatives by various governments for accelerating the deployment of public fast-charging infrastructure. Most organizations have deployed Level 3 DC fast chargers or Level 2 AC charging stations that can fully charge an electric vehicle within 30 minutes to 4 hours.

The slower charger segment is also expected to register significant growth. The slow chargers are mostly adopted by residential applications and are used for overnight charging. Moreover, most of the electric vehicle manufacturers provide slow chargers along with the purchase of electric vehicles, which is further driving the segment growth. The Level 2 segment accounted for more than 52% share of the global revenue in 2022.

All the Tech You Want

New models at Level 3 are being developed that have even higher energy outputs, 5G connectivity, infotainment displays using LCD/LED touchscreens, and AI-level applications like analytics-based load balancing, AC/DC power inversion, and DER (distributed energy resources) storage and integration.

AI (artificial intelligence) you say? FreeWire Technologies launched Mobilyze Pro, an AI-enabled platform designed to provide accurate predictions to efficiently and profitably expand nationwide EV charging infrastructure. The platform’s new tools, including a utilization prediction engine, a tariff recommendation engine, and a profitability calculator, leverage AI to parse through public and proprietary datasets to predict the best locations to deploy EV fast charging.

Mobilyze Pro is designed to help charging site hosts meet the rapidly growing demand for charging infrastructure by providing accurate utilization and profitability forecasts. These tools give owners of charging infrastructure the resources they need to compare site locations and hardware solutions, thereby providing confidence in the business case for EV charging and overcoming a key hurdle to accelerate deployment and access for drivers. The platform uses AI to make highly accurate predictions and optimize project economics, making EV fast charging more ubiquitous and more accessible to the public.

FreeWire has developed several features on the platform, one of which is a profitability calculator to predict operating costs and cash flow. This feature is powered by two key technical advances, including an AI-powered utilization prediction engine and a tariff recommendation engine. Utilization prediction analyzes charging activity data from thousands of existing public charging locations and correlates this data with EV drivers’ travel patterns, demographics, and vehicle ownership to predict how many sessions per day will occur at new charging locations.

The tariff recommendation engine allows site hosts to accurately quantify the impact of installing fast charging on their utility bills and identify the best utility tariff for their site. Together, these new tools enable site hosts and retailers to compare and rank thousands of locations at a time, allowing them to strategically identify the sites that will drive the highest utilization and best returns.

Connector Concerns

Today there are approximately 20 types of electrical plugs in common use around the world and many obsolete socket types are still found in older buildings. Any world traveler can relate to the difficulty of plugging in their connected vehicles in other countries. Even in a single country, there may be wall sockets that won’t accept the common plug-in use in that country; in the U.S., many older sockets are still two-wire, two-prong while the plug on your laptop will be three-wire, three-prong.

The standardization of EV charging connectors is similarly challenging. SAE Intl., will standardize the Tesla-developed NACS (North American Charging Standard) connector to ensure that any supplier or manufacturer will be able to use, manufacture, or deploy the NACS connector on electric vehicles and at charging stations across North America. Ford Motor Co., General Motors, Rivian, and a host of EV charging companies recently announced plans to adopt the NACS connector through adaptors or future product offerings.

Electrify America, for example, will continue to provide the CCS (combined charging system) connector throughout its network as it transitions to also support automakers adding NACS charging ports. The company will work to offer a NACS connector option at existing and future charging stations by 2025 to make charging as convenient as possible for EV owners.

CCS connectors are available in two types, CCS Type1 and CCS Type 2. CCS Type 1 connectors are extensively use in the U.S. while CCS Type 2 are utilized in Europe. Moreover, the support from major auto manufacturers and OEMs, including Daimler AG, Ford Motor Company, General Motor Co., and Volkswagen Group, is expected to drive the demand for the CCS segment.

Tesla’s fast charging strategy is proprietary and closed. Their vehicles can use adapters to fuel at most “generic” charging stations, but other vehicles cannot use Tesla’s superchargers. An open charging standard may use the OCPP (Open Charge Point Protocol), which is the key network communication protocol for DCFC stations and Charge de Move (CHAdeMO), which competes with the Tesla supercharger as a method for DC Fast Charging, and is adopted in almost all commercially available DCFC stations.

And, going by numbers alone, by 2025 China will have nearly 750,000 Level 3 stations installed, out of a global total of 943,000. The official EV plug standard in China is GB/T connector, which is used by all the EV chargers. According to Grand View Research analysis, in 2022, there were 7,082,307 EV chargers of all levels in China.

All OEM personal and commercial car and truck builders want the infrastructure necessary for their current and future vehicles. It makes sense that, with the infrastructure in place, more vehicles can and will be sold. Ford Pro, as an example, the commercial division within Ford Motor Co., added new charging hardware to its EV solutions to help make it easier for commercial customers to transition their fleets to electric.

The new Series 2 AC Charging Station 80 amp and expanded DC Fast Charger options are designed for commercial vehicle use, and coupled with Ford Pro’s charging management software, the company provides a fully integrated solution that simplifies EV charging for both Ford and non-Ford electric vehicles.

The Series 2 AC Charging Station 80 amp comes with enhanced security with RFID (radio frequency identification) that limits unwanted charger access. Fleet operators can issue a unique Ford Pro RFID card to control access to chargers enabling charging sessions to be limited to specific individuals or vehicles, by specifying day and times for access. The new RFID software also supports Ford and non-Ford vehicles, unlocking the ability for fleet operators to track energy reports through Ford Pro’s charging management software.

Ford Pro’s extended DC Fast Charger options in 180kW and 240kW gives fleet operators and their drivers more versatility with more power and shortened charge times. Aluminum pedestals feature an improved cable retractor, and the integrated software and hardware solution helps fleet managers optimize how, when, and where EVs are charged along with utility reimbursement reporting, important for home-based drivers.

EV charging stations serve as the crucial bridge between utilities power distribution and electric vehicle power consumption. Applications such as power inversion, off-grid power storage, and grid interactivity can optimize this bridging process, helping to avoid overload by the massive demand for EV charging that will soon be upon us.

Public EV charging station networks are inherently a high-technology digital business. They displace the legacy fueling model with a distributed, subscription-based approach enabled by software, analytics, and energy management to prevent EV charging from crippling the grid. Industry groups should continue to promote EV charging interoperability through open standards, and collaborate with OEMs and utilities to deploy faster, cheaper charging stations with energy storage and load balancing, thereby accelerating the shift to commercial EVs.

Want to tweet about this article? Use hashtags #construction #sustainability #infrastructure #IoT #AI #edge