If anything, 2022 was challenging for business in ways rarely seen. Costs up, inflation up, employment up and down, revenue for many up and down, and the inventory of skilled workers, down. At the end of 2022, the AGC (Associated General Contractors of America) and Sage cosponsored a survey that found construction contractors were less optimistic about many private-sector segments in 2023 than they were in 2022, but their expectations for the public sector market remained relatively bullish.

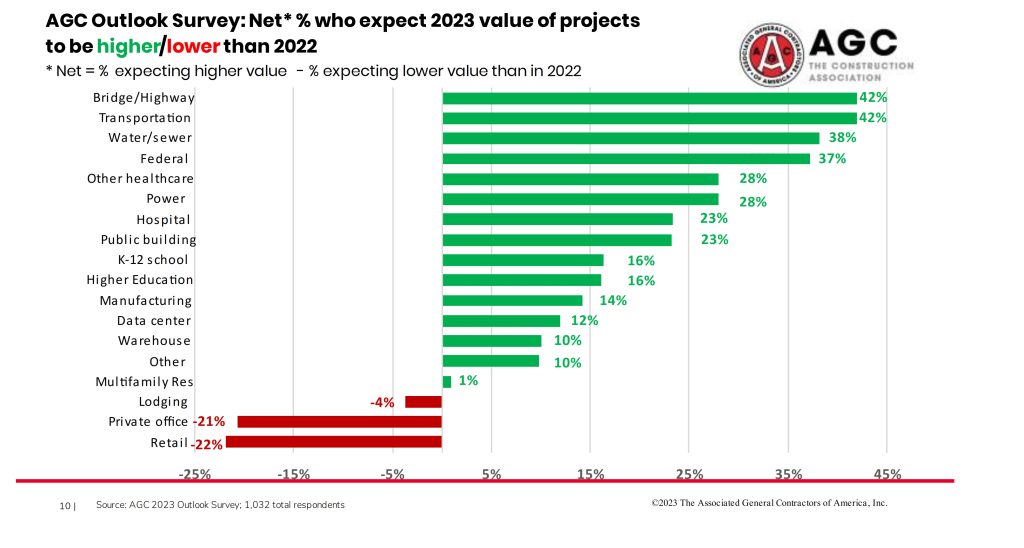

The net reading—the percentage of respondents to the survey who expected the available dollar value of projects to expand compared to the percentage who expected it to shrink—was positive for 14 of the 17 categories of construction included in the survey. Respondents were most optimistic about infrastructure categories. There were net positive readings of 42% for both highway and bridge construction and transportation projects. Contractors were almost as upbeat about sewer and water construction, with a net reading of 38%. The net reading for federal projects was 37%.

At the same time, many contractors hope to finally see some benefits from new federal investments in infrastructure and construction. This includes funding from the Bipartisan Infrastructure Law, the CHIPS Act, and the Inflation Reduction Act. In addition, many state and local governments have boosted their construction budgets as they have benefitted from a strong economy and a COVID-related influx of federal funds.

By the end of 2022, however, few contractors reported having been awarded government projects related to those acts. This is despite the fact the federal Bipartisan Infrastructure law was enacted in November 2021. Indeed, only 5% of respondents say they have worked on new projects funded by the law, while 6% have won bids but have not started work. Five percent say they have bid on projects but have not won any awards yet, whereas 21% plan to bid on projects but say nothing suitable has been offered yet.

Contractors continued to expect many of the challenges they faced in 2022 such as supply chain problems that have inflated the cost of many construction materials and delayed deliveries. Complicating things, these supply-chain challenges have been erratic and unpredictable. One week one material is in short supply, while the next week it is a different product. This makes it hard for contractors to make reliable cost estimates and anticipate production schedules.

An overwhelming 80% reported they were having a hard time filling some or all salaried or hourly craft positions, compared to only 8% who say they are having no difficulty. (The rest have no openings.) In addition, the majority—58%—of respondents said either hiring will continue to be hard or will become harder. Only 15% said it will become easier or remain easy to hire, while 27% expected no change.

Time changes

By May 2023, much of that January gloom seems to have lighten up. Sage’s annual survey of almost 12,000 business leaders globally, the “Small Business, Big Opportunity” survey, finds that despite the challenges of 2022, American SMB (small-medium businesses), including construction, are more confident than most of their global peers.

Out of the 2,147 U.S. SMBs surveyed, a third (33%) are “very confident” in their business right now (above the global average of 26%), with 38% of U.S. business leaders predicting that they will feel “very confident” about the success of their business at the end of 2023. A third (30%) of those surveyed expect their costs to decrease over the course of the year, while 63% expect their revenue to stay the same or increase next year.

This confidence is strongly linked to higher levels of tech investment, with 39% of U.S. SMBs citing successful tech adoption as a primary reason for their optimism (compared to 32% globally). Furthermore, over half (63%) of those surveyed say that they are planning on accelerating their tech investment further (compared to 53% globally).

However, although U.S. SMBs anticipate increasing their technology investment by a fifth (21%) over the next twelve months, those surveyed cite lack of budget and issues with successfully integrating new technologies as the main barriers. Looking to the next three years, U.S. business leaders expect to deploy emerging technologies such as 5G internet (41%), AI (31%) and cryptocurrency (23%).

In 2022, inflation presented a significant barrier for many U.S. companies, almost a quarter (23%) saw their costs increase by 10-24%. However, those surveyed report working more efficiently to overcome challenges: over three quarters say they are satisfied with current productivity levels, and a third report that this helped them overcome barriers in 2022.

Challenges remain regarding hiring, however. Access to talent remains a critical concern, with half (52%) of small businesses in the U.S. stating that hiring the employees they need is at least “quite a big problem”, compared to the global average of 45%.

The difficulty in finding skilled workers is one reason technology implementation has increased. Rarely capable of replacing a skilled office worker or project manager, technology can aid those who deal with data to make quicker and better decisions. Since Sage did their survey, they were aware of the specific needs of growing SMB companies and moved to ensure their place as a premium supplier of technology to that market.

Technology Moving Forward

In April 2023, Sage launched Sage Intacct on Microsoft Azure in the U.S. market This release comes shortly after the debut of Sage Active on Microsoft Azure in France, and is the latest demonstration of Sage’s commitment to providing scalable solutions to SMBs globally. The combination of Sage Intacct and Microsoft Azure offers SMBs the power of Sage’s award-winning cloud financials solution in Microsoft’s secure and user-friendly cloud environment. Sage Active, Sage’s new cloud native European accounting solution for SMBs, launched in France in February, and is set to launch in Spain and Germany later in 2023. With the availability of these core solutions on Microsoft Azure, SMBs can now benefit from the flexibility and scalability provided by the platform when selecting Sage products.

The Sage and Microsoft partnership aligns with the sustainability objectives of both businesses, with a shared goal to promote sustainable development and low-carbon business practices globally through cloud-enabled technologies. Sage has pledged to fight climate change and become net zero by 2040. Microsoft has pledged to be carbon negative by 2030, with a focus on four key areas of environmental impact to local communities: carbon, water, waste, and ecosystems.

In May 2023, Sage acquired Corecon, a cloud native preconstruction and project management solution. The acquisition expands Sage’s relationships with customers beyond financials and reinforces its position as a leading provider of cloud native technology for the construction industry by providing a solution to efficiently manage projects from bid to closeout.

Corecon has applied its extensive construction industry knowledge to develop a user-friendly preconstruction and project management software solution, enabling growing construction companies to win new work, easily connect project teams, build more efficiently, and optimize profitability. Corecon’s customers primarily include general contractors, construction managers, subcontractors, and custom homebuilders.

Corecon’s preconstruction and project management solution remains technology agnostic, and will integrate with third party ERP and accounting systems, as well as Sage Intacct Construction, Sage 300 Construction and Real Estate, and Sage 100 Contractor. The acquisition will provide customers with the power of choice – the flexibility to choose the right combination of Sage and partner solutions that best meets their needs.

By digitizing business processes and relationships with customers, suppliers, employees, banks, and governments, Sage’s digital network connects SMBs, removing friction and delivering insights. Incorporating Corecon Technologies preconstruction and project management software solutions for general contractors, construction managers, subcontractors, and custom homebuilders will give Sage inroads to many more construction projects.

Want to tweet about this article? Use hashtags #construction #sustainability #infrastructure #AI #5G #cloud