An overview of IoT at the year’s halfway point, plus a spotlight on verticals—energy, automotive, buildings, and retail—shows both challenges and opportunities.

Just as industries were coming out of the COVID-19 haze, boom—more trouble. 2022 has brought global unrest, war in Eastern Europe, economic uncertainty, supply chain unpredictability, soaring energy prices, inflation, a massive chip shortage, and, sadly, the list doesn’t end there. The continuing fallout from COVID-related shifts in industries and the global economy weren’t over before a new, intense wave of challenges hit hard. How have the events and realities of the first half of 2022 affected the IoT (Internet of Things) implementations and the IoT space as a whole? How are companies and industries leaning on IoT to power through challenging times? And how are the hurdles and opportunities presented in the first half of 2022 shaping the near-term future in verticals like energy, automotive, buildings, and retail?

According to Research and Markets, the global IoT market brought in $190.26 billion in revenue in 2021. The firm reports these 2021 numbers indicate a market recovery compared to 2020, when the COVID-19 pandemic prompted many companies to cancel or postpone IoT projects. Research and Markets’ revised forecast for 2022-2023 further suggests that revenue growth rates will slow down by 20% in 2023, despite continued and even rising demand for hardware, platforms, and software-for-IoT solutions.

Josh Siegel, assistant professor in computer science and engineering and lead instructor for the DeepTech Lab at MSU (Michigan State University), says so far, 2022 has continued to build on 2021’s themes of unpredictability and pent-up demand leading to unexpected challenges and challenge-driven innovation. “Broadly, I would say that within IoT, supply chain shortages continue to impact the creation of IoT devices and systems, making for a less competitive—and costlier—market than was true previously,” Siegel says. “Some IoT implementations are being postponed, downscaled, or moved to alternative technologies and platforms.”

For smaller organizations, R&D (research and development) costs have, in some cases, become unsustainable or at least suffered from delays. “And for larger organizations, IoT device and platform diversity has grown in unanticipated ways—e.g., due to highly variable component availability necessitating microcontroller, memory, or other component interchange,” adds Siegel. “This is leading to some issues with fragmentation and interoperability. On the positive side, some new IoT hardware and software is designed to be increasingly flexible with respect to makeup—and this may ultimately prove an asset in reducing single-source design prevalence.”

IoT at the 2022 Halfway Point

Dimitrios Spiliopoulos, industrial IoT lead for manufacturing and supply chain, EMEA (Europe, the Middle East, and Africa) for AWS (Amazon Web Services) and IoT adjunct professor at IE Business School, says IoT adoption continued during the first half of 2022, even in the face of challenge. “Events such as the war in Ukraine, disruptions in the global supply chain, shortage in semiconductors, the impact of the pandemic, (and) challenges to recruit or retain talent have created delays in the implementation of some IoT projects. Despite these events, organizations see so much power in IoT that even with challenging conditions, they are expanding their adoption of IoT. In fact, I see the challenges are helping companies understand the value of digital transformation so they can have the visibility to act quickly when conditions change. In addition, we hear from customers that the increasing debate and attention to sustainability since COP26, combined with the increase of energy bills has given a new focus on the IoT market, especially in sectors like manufacturing, smart buildings, renewables, and energy. This momentum has made more companies consider sustainable solutions enabled by IoT and other technologies like cloud, machine learning, and digital twins.”

Similarly, Spiliopoulos says IoT can help companies with the types of challenges brought on during the first half of 2022. “Companies that had already adopted IoT in their production facilities, supply chain, or in their products have managed to adjust faster to all these events,” he explains. “With the challenge of increased energy bills, IoT can help companies optimize their energy consumption in their factories, buildings, and products. Energy optimization is a use case that can drive both cost reduction and sustainability outcomes; thus, I see special interest in the market and also from vendors. The challenge of recruiting or retaining talent can be alleviated to a certain extent by adding connectivity and intelligence in assets like production machines, vehicles, buildings, etc. The realtime insights and automation that can come from combining IoT and AI (artificial intelligence) can help companies use their workforce and assets efficiently, allowing them to allocate proactively resources to the most important issues and tasks. Overall, industrial IoT use cases like production monitoring and optimization, predictive maintenance, quality monitoring, and others can help companies reduce carbon footprint, (which is) one of the biggest challenges of our humanity, but also become more resilient, safe, and reduce costs. All these are very useful to deal also with the supply chain disruption by bringing more transparency and visibility to the whole process.”

Laine Mears, acting department chair of automotive engineering and professor and chair of automotive manufacturing at Clemson University, adds a major stumbling block for current implementation of IoT approaches is hardware availability. “Semiconductor shortages have driven lead times for commodities such as monitors, as well as all types of microcontrollers to months and, in some cases, tripled prices,” Mears says. “This has made easy the short-term decision for some small businesses to wait on pilot studies, and in other cases hindered ongoing efforts, including those in my own department.”

Information flow, however, is alive and well. “Conferences are in-person now, with some continuing hybrid offerings for hearing the latest technical findings and building academic and industrial networks for cooperation,” Mears explains. “The federal government is continuing to move forward with identifying risks and opportunities with AI, and serious investment has begun for understanding quantum computing, which holds the promise of breakthroughs that could have a profound effect on AI and intelligent industrial applications.”

In fact, the IoT could be just the thing that helps businesses press through the rest of the year and into the next several years with their heads held high. C. Lindsay Anderson, professor of biological and environmental engineering and systems engineering at Cornell University, interim director of the Cornell Energy Systems Institute, and senior fellow of the Cornell Atkinson Center for Sustainability, points out the importance of IoT technologies in navigating the ups and downs of supply chains. “IoT can provide increased awareness and intelligence in complex systems—for example, supply chains,” she says. “As supply chains move toward more distributed architectures, more IoT deployment will be critical to maintaining efficient and reliable operations.”

MSU’s Siegel says there are several ways the IoT and associated technologies, such as advances in sensing, networking, computation, AI, actuation, and feedback systems, can help alleviate business crises like those the world has seen so far in 2022. “IoT can readily enhance supply chain, logistics, and asset management by providing pervasive and transparent insights that were previously untenable,” he says. “Full-chain tracking with trustworthy provenance can help to lower costs and improve yields for food, fuel, energy, manufactured goods, and more.”

Further, Siegel points to IoT’s ability to lower manufacturing costs and improve quality, improve sourcing across industries, and enable digital twins and predictive maintenance as benefits during times of global unrest and economic uncertainty. Clemson University’s Mears adds businesses that have taken seriously the importance of visualizing the realtime states of operation hold an advantage in these times of limited supply.

5 Ways IoT Can Alleviate Business Crises

Josh Siegel of MSU shares five ways the IoT can help alleviate business crises:

- IoT can readily enhance supply chain, logistics, and asset management by providing pervasive and transparent insights that were previously untenable.

- IoT can be used to lower manufacturing costs and improve quality—e.g., through smarter manufacturing, elastic (demand-responsive and regionalized) production, and by building the right mix and features of products through targeted, data-informed product design and development.

- IoT can be used to improve sourcing across industries—e.g., to identify the best-producing factory or farm and to help factories and farms optimize their input/output relationship (their overall efficiency).

- IoT-enabled digital twins and predictive maintenance will play a significant role in keeping costs down, particularly for manufacturing and transportation.

- In the longer term, IoT’s role in enabling the metaverse may help reduce the need for certain assets’ physicality, while also providing new means of engaging with systems and their (meta)data.

“They are able to track sparse materials deeper into the supply network and adapt more easily to availability,” Clemson explains. “Within the factory walls, IoT continues serving to make the best use of these materials, along with people and other resources through keeping scrap low, maximizing productivity, and effectively planning resource allocation to minimize downtime. IoT technologies are not the ‘magic bullet’ to make trying economic conditions go away, but they will help companies weather such conditions better through a continuously improving realtime understanding of their operational conditions.”

Similarly, Spiliopoulos says IoT can help companies with the types of challenges brought on during the first half of 2022. “Companies that had already adopted IoT in their production facilities, supply chain, or in their products have managed to adjust faster to all these events,” he explains. “With the challenge of increased energy bills, IoT can help companies optimize their energy consumption in their factories, buildings, and products. Energy optimization is a use case that can drive both cost reduction and sustainability outcomes; thus, I see special interest in the market and also from vendors. The challenge of recruiting or retaining talent can be alleviated to a certain extent by adding connectivity and intelligence in assets like production machines, vehicles, buildings, etc. The realtime insights and automation that can come from combining IoT and AI can help companies optimize their workforce and assets, allowing them to allocate proactively resources to the most important issues and tasks. At the same time, lots of manual and repetitive tasks can be eliminated using IoT, allowing the existing workforce to focus only on added-value tasks. Overall, industrial IoT use cases like production monitoring and optimization, predictive maintenance, quality monitoring, and others can help companies reduce carbon footprint—one of the biggest challenges of our humanity—and waste in general, but also become more resilient and reduce costs. All these are very useful to deal also with the supply chain disruption by bringing more transparency and visibility to the whole process.”

A Vertical IoT Outlook

Energy

The global IoT in energy market will reach $75.3 billion by 2026, according to Facts & Factors Research. Massoud Amin, professor of electrical and computer engineering at the University of Minnesota, who is widely credited as being the “father of the smart grid,” says the main drivers for smart-energy implementations in 2022 will continue to include better connectivity and secure networking within smart grid, enabling components and subsystems. “Adoption of sensors has been increasing due to rising integration of IoT technologies with smart grids,” he says. “This has enabled a more rapid transition to more flexible power grids and integrations with renewable resources, micro-grids, and DERs (distributed energy resources).” Key barriers, Amin adds, include complexity, awareness, standards, privacy concerns, and security.

Cornell University’s Anderson says with the increase in gas prices, mostly arising from the war on Ukraine and sanctions against Russia, it is likely the trend toward EV (electric vehicle) adoption will accelerate. “IoT plays a significant role in EVs and will be essential to the use of ubiquitous EVs to provide grid flexibility in support of the kind of large-scale renewable energy integration we require to meet the 2030 and 2050 climate targets,” she says. “As the electric power system becomes more decentralized, the ability to control the system in a reliable and sustainable way will be contingent on access to—and ability to act on—realtime information at very high temporal and spatial resolution, which will need large-scale deployment of IoT.”

Automotive

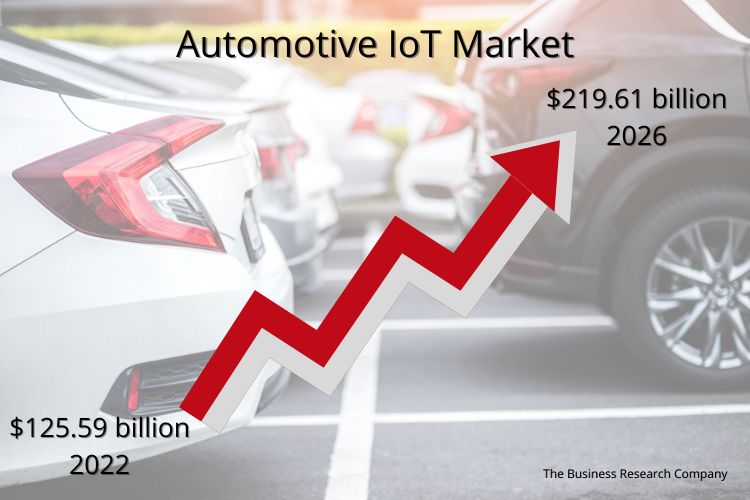

The Business Research Company’s data suggests the automotive IoT market will reach $125.59 billion in 2022 and $219.61 billion in 2026. Clemson University’s Mears says the Q3-Q4 outlook for automotive IoT will include growth. “Automotive is made up of a deep and interwoven data network necessitated both by the size and urgency of deliveries in a just-in-time, build-to-order environment,” he explains. “Business pressures have motivated several investments through pilot studies, data infrastructure improvements, and people investments, such as forming transition teams and training personnel in new technologies. These investments are seen as critical to business, and though we can’t accurately predict the turns of the economy and their effect, technologies which improve realtime understanding of logistics and factory operations will see continued implementation and work on new applications. This is particularly relevant in light of the incredible EV investment announcement in the past 12 months. New factories can be planned smart from the outset, new supply chains-built information-rich, and the products themselves designed to be much more networked and communicative.”

MSU’s Siegel says within the automotive space, more trends to watch include telemetry systems and subscription-based features continuing to grow; the continued shift to the “software-defined car,” necessitating IoT for secure software updates; and increasing applications for C-V2X (cellular vehicle-to-everything) connectivity, demanding refined IoT implementations in vehicles and requiring higher bandwidth and lower-latency networking. “IoT will continue to be deployed at OEMs (original equipment manufacturers) and suppliers as a means of enhancing supply chain and production quality while assuring equipment uptime and reducing operating costs,” adds Siegel. “Data from consumer vehicles will be used in aggregate to design better next-generation vehicles that deliver heightened value/cost.”

Buildings

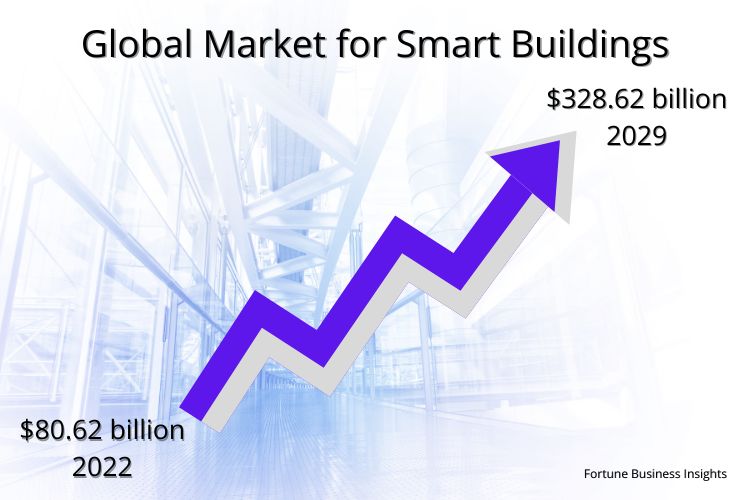

The global market for smart buildings is set to grow from $80.62 billion in 2022 to $328.62 billion by 2029, predicts Fortune Business Insights, but global events are playing a role in how the space is moving forward. Ajla Aksamija, professor in School of Architecture at the University of Utah, whose research focuses on building science, high-performance buildings, advanced building technologies, and innovations in architecture and facade systems, says recent global events have had a profound impact on people’s lives, and the built environment has also been impacted by these events. For instance, during the COVID-19 pandemic, homes had to become office spaces, classrooms, and spaces for entertainment, while commercial buildings, theaters, sports arenas, museums, and civic centers sat empty for significant periods of time. In 2022, people and the buildings they occupy are still adjusting to whatever the “new normal” will be.

“The question remains—what is the future of built environment?” Aksamija says. “How will digital connectivity influence buildings of the future? Digital connectivity will influence the way buildings are designed and operated. Buildings will have to adapt to our ‘new normal,’ including remote/hybrid working, learning, and socializing.”

Retail

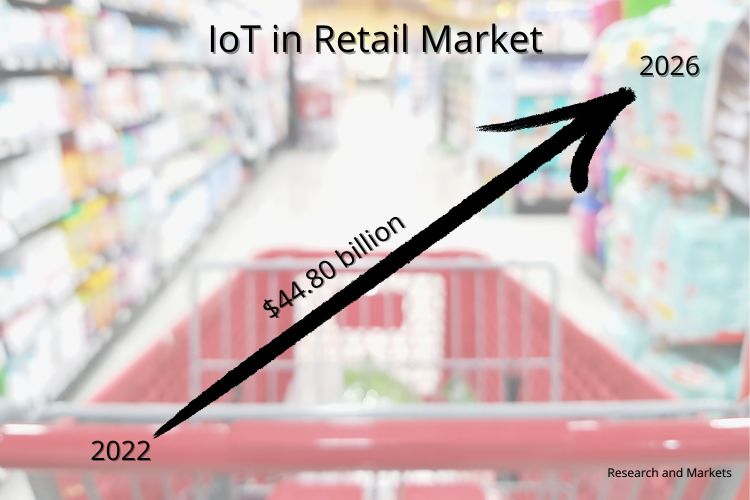

Despite economic uncertainties, Research and Markets suggests the IoT in retail market will grow by $44.80 billion between 2022 and 2026. In 2022, Spiliopoulos from AWS says retail and all sectors related to assets can and are benefiting from leveraging IoT technologies, for instance, for sustainability and efficiency in their production or products, either as a response to the global events or because of their long-term strategy. “For example, manufacturers of cars, of building materials, or of consumer products are looking not only to find ways to reduce their energy consumption and bills (and) automate and optimize processes, but I am seeing the great trend of them trying to offer more transparency to their customers—either consumers or businesses—by applying track-and-trace IoT applications and sharing information from the production to consumption, like origin and carbon footprint,” Spiliopoulos says.

Another key trend is paying more attention to smart products’ end of life. “Companies with smart products are considering how to take care of the end of life of their products, like a car, a machine, etc., in the concept of circular economy and Industry 5.0,” Spiliopoulos adds.

Besides causing some strife, 2022 has also initiated a level of introspection among industries that have implemented IoT and those that are looking to implement IoT. Siegel says the timing has been forced, but the outcome in the long term will most likely be positive, as this introspection will lead to more thoughtful design, deployment, use, and maintenance of IoT systems within existing industries and at the core of emergent industries.

All in all, halfway through 2022, he concludes: “I think IoT is in a pretty good place, all things considered. Increased focus on privacy, security, energy efficiency, and interoperability are probably the biggest areas for growth right now—and also the biggest opportunities. We’re far better off than we were several years ago, but we do have a long way to go, and the field will continually evolve as new use cases are envisioned and built out.”

Links for Further Learning:

- Biden-Harris Administration Proposes New Standards for National Electric Vehicle Charging Network

- Semiconductor shortage: How the automotive industry can succeed

Want to tweet about this article? Use hashtags #IoT #sustainability #AI #5G #cloud #edge #digitaltransformation #machinelearning #energy #retail #buildings #automotive #EVs #semiconductors #COVID19 #economy#supplychain #digitaltwins #manufacturing #AWS #circulareconomy